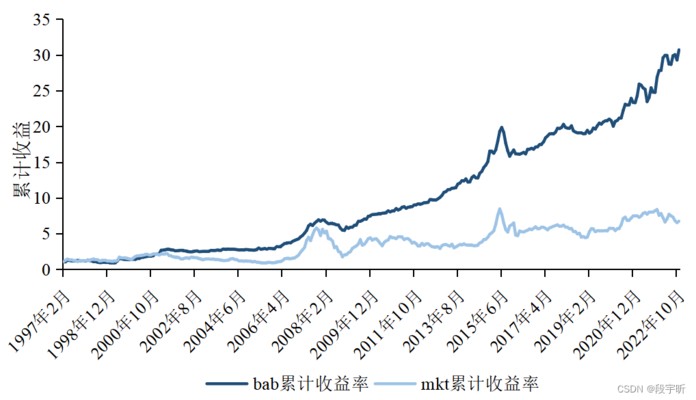

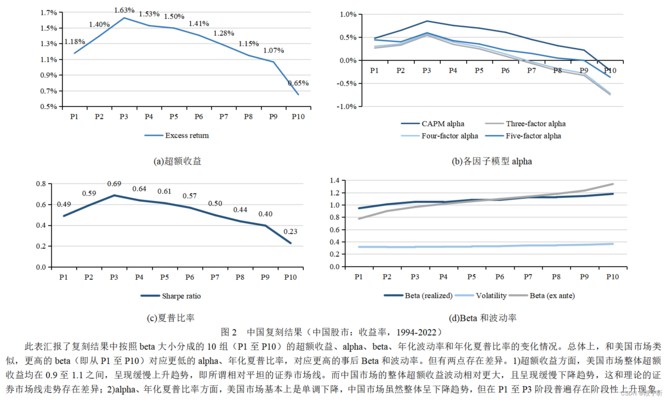

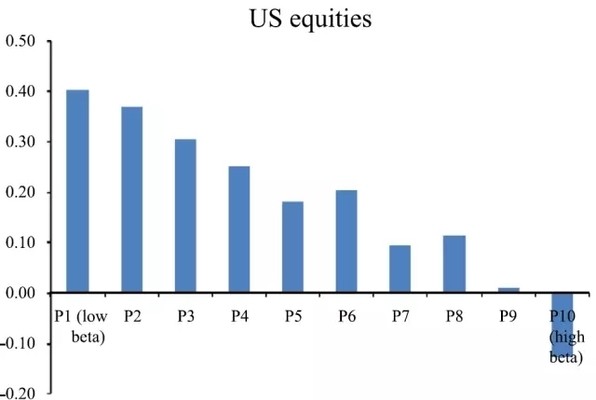

对于该理论进行了进一步的验证,并提出了BAB因子(Betting Against Beta)。 而另一部分学者认为 低风险效应 与投资者行为相关,他们认为投资者 Andrea FrazziniLasse H. PedersenLinkedInWe present a model in which some investors are prohibited from using leverage and other investors' leverage is limited by margin requirements. The former investors bid up high-beta assets while the latter agents trade to profit from this, but must de-le. beat head against有效地抵抗.As against与比较 比起来. Journal of Financial Economics 111 (2014) 1 –25 Contents lists ailable at ScienceDirect Journal of Financial Economics journal homepage: Betting against beta $ Andrea Frazzini a, Lasse Heje Pedersen a,b,c,d,e,n a AQR Capital Management, CT 06830, USA b Stern School of Business, New York University, 44 West Fourth Street, Suite 9-190, NY 10012, USA c Copenhagen Business School, 2000 Frederiksberg, Denmark d Center for Economic Policy Research (CEPR), London, UK e National Bureau of Economic Research (NBER), MA, USA a r t i c l e i n f o a b s t r a c t Article histo ElectroniccopyavailablefindstrongconfirmationU.S.equitydata,provideevidencealternativeexplanation.Portfolioregressionanalysesshowbettingagainstbetaphenomenondisappearsaftercontrollinglotterycharacteristicsoursample,whileothermeasuresfirmcharacteristicsriskfaileffect.Furthermore,betting. betabettingyaleuniversityfrazzinileverage.BettingAgainstBetaAndreaFrazziniBettingAgainstBetaAndreaFrazzinidraft:September13,2010Abstract.Wepresentwhichsomeinvestorsprohibitedfromusingleverageotherinvestors’leveragemarginrequirements.formerinvestorsbiduphigh-betaassetswhilelatteragentstradeprofitfrommustde-leverwhenmarginconstraints.Wetestmodel’spredictionswithinU.S.equities,across20globalequitymarkets,Treasurybonds,corporatebonds,futures.Consistentmodel,wefindeachassetclassbetting-against-beta(BAB)facto 一、引言与综述二、信息应对和复刻细节(一)信息来源(二)估计事前beta(三)构建BAB因子1.排序和分组2.加权3.估计BAB因子的收益率三、中国A股市场的实证复刻推论四、读后感和相关讨论参考文献附录(SAS代码)一、引言与综述.E [ r j ] = E [ r z ] ( 1 − β j ) + E [ r m ] β j E[r_j]=E[r_z](1-\beta_j)+E[r_m]\beta_jE[rj]=E[rz](1−βj)+E[rm]βj. 由Andrea Frazzini和Lasse Heje Pedersen撰写的Journal of Financial Economics2014年1月论文 Betting against beta 建立了一个不同投资者、不在此之时间的包含杠杆和资金约束的模型,发现了与模型五个核心命题一致的实证证据:(1)有约束的投资者追逐高.发现,当资金流动性风险高时,beta值的离差明显降低,这与模型对Beta压缩的推断一致。. betting against beta:与测试版.Betting against beta. 人家作者说过了,这个策略一般在流动性紧张(比如08/09金融危机)的时候会亏损的很厉害,一般用1.4杠杆的都熬但是去。 必须要和巴菲特那样有很低价很稳定的杠杆才可能有效的把BAB策略的超额回报优势发挥出来,否则就光是Sharpe Ratio上好看而已。 SPLV无杠杆情况下轻微跑赢完全是回测时段选择上做了手脚。卖ETF的,比如IShares, PowerShares,特别爱玩这个把戏,光把跑赢的时段拿出在Fact Sheet上秀。 首页